You do not need to be an AARP member to enroll in a Medicare Advantage plan or Medicare Prescription Drug plan. Enrollment in these plans depends on the plan's contract renewal with Medicare. Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract and a Medicare-approved Part D sponsor. Medicare Advantage plans and Medicare Prescription Drug plans FOR COSTS AND COMPLETE DETAILS (INCLUDING OUTLINES OF COVERAGE), CALL A LICENSED INSURANCE AGENT/PRODUCER AT THE TOLL-FREE NUMBER ABOVE. THESE PLANS HAVE ELIGIBILITY REQUIREMENTS, EXCLUSIONS AND LIMITATIONS. You must be an AARP member to enroll in an AARP Medicare Supplement Plan. A licensed insurance agent/producer may contact you. Government or the federal Medicare program. Not connected with or endorsed by the U.S. In some states, plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease. Each insurer has sole financial responsibility for its products. Insured by UnitedHealthcare Insurance Company, Hartford, CT or UnitedHealthcare Insurance Company of America, Schaumburg, IL (for ND residents) or UnitedHealthcare Insurance Company of New York, Islandia, NY (for NY residents). Please note that each insurer has sole financial responsibility for its products.ĪARP ® Medicare Supplement Insurance PlansĪARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare. AARP does not employ or endorse agents, brokers or producers.ĪARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals. AARP and its affiliates are not insurers. These fees are used for the general purposes of AARP. UnitedHealthcare pays royalty fees to AARP for the use of its intellectual property. Also, you may be able to reduce your health care costs if you take steps to: Think about how you will use your benefits and consider all the costs of Medicare.

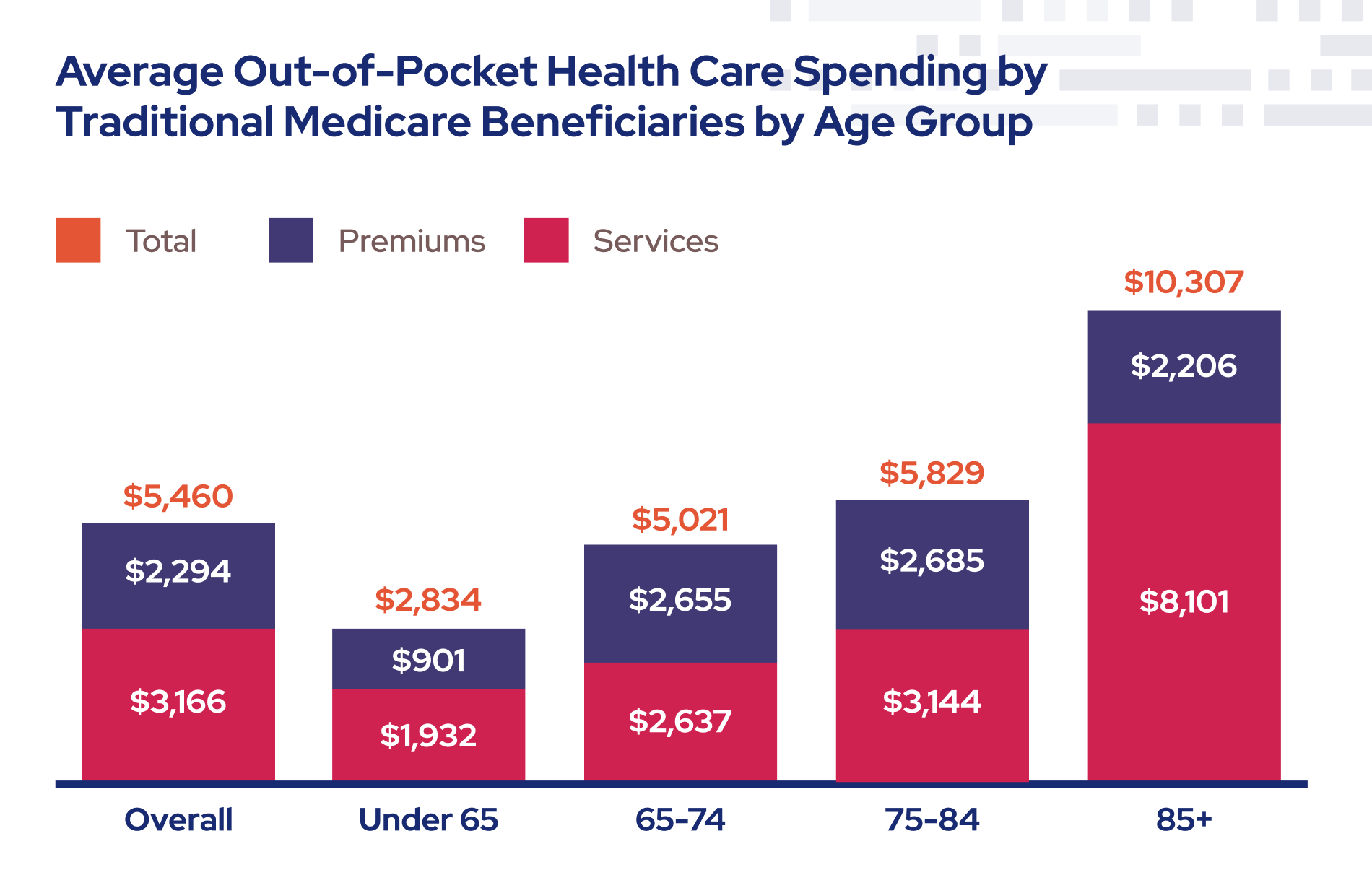

The reverse could also be true-a seemingly high premium but low out-of-pocket costs. You may have to pay a large deductible, or you might have high co-pays for doctor visits or prescriptions. For example, a plan with a low monthly premium might end up costing you more. Why? Because sometimes a plan may look like a good choice with a low premium but may actually cost you more with high out-of-pocket costs. But it's a better idea to look at all of your Medicare costs together-including both your premiums and all out-of-pocket costs. Premiums are regular monthly expenses that must fit into a budget, and most of us are aware of our monthly expenses. It's easy to focus on just premiums when looking at how much a plan can cost. Learn More About Medicare Supplement Insurance Plan Costs There are different plan options available in Massachusetts, Minnesota and Wisconsin. Benefits, if covered, are covered 100% by most plans. Once you meet the annual out-of-pocket limit, the plans pay 100% of covered services for the rest of the calendar year. These plans offer a lower monthly premium than other Medicare supplement plans because they pay a percentage of the coinsurance and you pay the rest. There are 2 Medigap plans (Plan K and Plan L) that have a yearly out-of-pocket limit. Benefits and costs vary depending on the plan you choose. Medigap plans offer peace of mind with predictable out-of-pocket costs. For example, the only out-of-pocket costs associated with Plan G would be your monthly premium and the annual Part B deductible ($226 in 2023). There are Medigap plan options available with low to no copays. Medicare supplement (Medigap) plans are designed to help limit out-of-pocket costs by helping to pay for some of the costs Original Medicare (Part A and Part B) doesn't pay. Learn More About Medicare Advantage Plan Costs Costs that don't apply to your annual out-of-pocket maximum include premiums, Part D prescription drugs, and extra benefits your plan might have that aren't covered by Original Medicare. After you reach the annual out-of-pocket maximum, your plan will pay all your costs for Medicare-covered services for the rest of the plan year. For 2023, the annual out-of-pocket maximum limit is $7,400. Medicare Advantage plans choose their own out-of-pocket maximums that are less than or equal to the one set by Medicare for the year. This is called the out-of-pocket maximum, and each year the limit is set by Medicare. Medicare Advantage plans also limit how much you'll pay out of pocket every year.

Not all plans will have deductibles, copays or coinsurance, so check each plan's cost-sharing rules carefully. Each Medicare Advantage (Part C) plan sets its own specific costs, but the types of costs you may pay include premiums, deductibles, copays and coinsurance.

0 kommentar(er)

0 kommentar(er)